Settle Your

Small Business Debt.

$118,934,620 IN SETTLEMENTS NEGOTIATED 🚀

Empowering small businesses to regain control by negotiating debt and shifting focus to profit.

Trusted by Businesses

Are you facing collection calls from creditors or vendors? Feeling uncertain about future cashflow? PRG’s strategic debt settlement solutions will help you regain control and restore stability to your business finances.

Take Control of your Business by Settling your Debt

You’ve worked tirelessly to start and grow your small business, but now you’re facing an existential threat that puts your future in jeopardy. You’re facing aggressive creditors and possibly even legal action, and the pressure to find a quick solution is overwhelming. The stress of navigating this crisis can feel insurmountable, but you don’t have to face it alone.

Benefits of Debt Settlement

Business Debt Relief

Debt settlement helps lift the burden of overwhelming debt, giving you the peace of mind needed to focus on growing your business.

Alternative to Bankruptcy

By negotiating a settlement that provides manageable payments, you can regain control over your finances and restore predictability to your cash flow.

Benefits of SimpleSettle

Expert Negotiation

Our team of skilled negotiators leverages their extensive experience to navigate the intricacies of your financial situation, helping to maximize your position in negotiations and secure the best possible outcome.

Transparent Pricing

Our program features upfront and straightforward pricing, with no hidden fees or unexpected costs, so you know exactly what to expect.

Curated Outside Legal Network

Gain access to an outside network of carefully selected attorneys who can offer valuable insights and legal protection, ensuring comprehensive legal support during the negotiation process.

Custom Strategy

We understand that each business is unique, which is why we develop personalized strategies aligned with your specific needs, ensuring a solution that fits your financial capabilities and goals.

Negotiate on Your Timeline

As every situation is unique, some businesses require faster results, but others need time. With PRG, you can evaluate risk and develop a plan best suited for you; including time management.

Optimize Your Negotiations

By handling the negotiations, our experts allow you to focus on what matters most—running your business. Choose PRG’s SimpleSettle Negotiations & Debt Settlement program to take back control of your finances, eliminate stress, and secure a brighter future for your business.

Increase Available Cash Flow

With your debt under control, you’ll have more cash flow available to reinvest in your business and finance your company’s growth on your own.

Gain Peace of Mind

Gain peace of mind knowing you have a tailored results-based strategy and an dedicated team of negotiators supporting you.

Know Your Options

When faced with unsustainable debt and collections, it’s crucial to understand the available options for relief. From PRG’s strategic SimpleSettle program to handling the situation yourself, each approach offers distinct benefits and risks. This comparison will help you make an informed decision and choose the best path forward for your business.

Options

Pros

Cons

Options

Benefits

- Transparent Pricing & Affordable Fees: Easy-to-read, simple contract with no hidden costs.

- A Dedicated Expert Negotiator on Your Team: A professional negotiator who leads your debt resolution, is in continuous communication.

- A Customized Strategy: Each situation is unique, so a tailored, strategic approach is essential to achieve the best outcomes.

- A Curated Outside Legal Network in Several US States at Pre-Negotiated Affordable Rates: Offers access to licensed outside legal professionals.

- Optimize Your Resources: Maximize savings and improve cash flow, freeing you to run your business without the stress of dealing with aggressive creditors on your own.

Risks

- Brutal Honesty: You might receive straightforward feedback that can sometimes be tough to hear, but it’s essential for developing a realistic debt settlement strategy.

- PRG May Not be the Best Fit for Your Situation: If you’re considering raising a material dispute, we may not be the best fit. PRG’s focus is on negotiation, settlement, and optimizing your company’s cashflow.

Options

Benefits

- Access to Legal Expertise: If you want immediate legal advice, this is your best option. If settlement is not your primary objective, you should consult with a licensed attorney.

Risks

- High Costs for Legal Representation: According to Clio’s 2024 Legal Trends Report, the average rate for attorneys in the United States is $327 per hour.

- Experts in Their Field: Although skilled in the legal matters, many law firms do not focus on optimizing your business’ financial needs.

Options

- a) Escrow Accounts

Benefits

- Forced Escrow Account for Debt Settlement: While a lump sum payment is beneficial for negotiations, it’s unnecessary to have a debt settlement company ‘hold’ your money, as they may deplete it before its intended use.

Risks

- Extremely Expensive with High Cancellation Fees: These companies often charge high costs, including substantial fees for cancellation.

- Negotiation Delays: They delay starting negotiations until clients save a significant percentage of the debt amount, leaving them extremely vulnerable during this period. In some cases, the debt company’s fee is paid before any offers to the creditors are even proposed.

- Risk of Judgments and Levies: While saving toward a lump sum, these companies may not intervene to address legal actions, leaving clients exposed to potential legal risks that can be detrimental to the company and its owners.

- Complex Contracts: The contracts can be lengthy and often restrictive, making it difficult for clients to understand the terms of the agreement.

Options

- b) Zero to Low Starting Fees

Benefits

- Low or No Initial Costs

- Easy Admission Into a Debt Settlement Program

Risks

- Hidden Fees or Higher Costs Later On: Initial low fees can be deceptive, with additional costs emerging as the process continues.

- May Not Deliver Promised Results: These companies might overpromise and underdeliver, leaving clients disappointed with the actual outcomes.

- Volume-Based Approach: Their business model prioritizes volume, which often leads to less personalized attention and inadequate handling of critical negotiations, leaving some clients vulnerable.

Options

Benefits

- No Initial Costs

- Complete Control Over Negotiations

Risks

- Significant Time Investment: Managing daily business operations while focusing on negotiations is extremely challenging. Economists refer to this as ‘distraction costs’, and these costs can be significant.

- Massive Learning Curve: Mastering negotiations and comprehending the associated risks require years of experience and cannot be learned quickly.

- Possibility of Unfavorable Outcomes: The probability of achieving the most ideal outcome is reduced when attempting to do it yourself.

- Mistakes can be Costly: Simple oversights can have catastrophic consequences. For instance, not understanding your company’s true cash position, or offering a settlement that is not sustainable, can set you up for failure.

- Your Words can be Used Against You: Previous statements and offers may hinder your ability to achieve the best possible outcome.

Options

Benefits

- No Initial Costs

Risks

- Possible Severe Consequences: The debt will not go away if you ignore it. A wide array of adverse consequences could occur. Seek legal counsel to better understand what those consequences might be given your unique situation.

Options

Benefits

- Last Resort: If settlement negotiations fail, bankruptcy can often be chosen as a final option.

- Structured Repayment Plan and/or Reorganization: Consult a licensed attorney in your state to explore various bankruptcy options.

- New Beginning: Bankruptcy can sometimes give you the fresh start that you need.

Risks

- High Costs: The bankruptcy process can be expensive, involving substantial fees.

- Impact on Credit: Bankruptcy can severely damage a business’s and/or an individual’s credit score for many years.

- Public Record: Bankruptcy filings are public record, which can affect your reputation.

- Future Business Endeavors: It may be challenging to start new business ventures in the future.

- Emotional Impact: The process of going through bankruptcy can be stressful and emotionally draining for business owners and employees, impacting morale and productivity.

The SimpleSettle Difference

Comprehensive Debt Settlement System

PRG’s comprehensive debt settlement system is specifically designed for small business owners who requires affordable expertise and efficiency.

- Save money, time, and achieve peace of mind.

- Develop a customized strategic plan with your assigned negotiator at an affordable price.

TRUSTED Outside Legal Network

Our carefully curated outside attorney network is available to you as an additional resource.

Our Approach

Working together to advance our clients’ objectives & achieve common goals.

PRG’s Expert Guidance

PRG’s specialized expertise helps you navigate the intricacies of complex debt negotiations, freeing you to allocate resources effectively while focusing on your core business activities.

Free Up Time to Focus on Your Business

PRG associates seamlessly integrate into your team, aligning with your company’s culture while collaborating with your employees to enhance their skills and performance. Through these efforts PRG facilitates the development of better overall financial operations, empowering your team for sustainable growth and profitability.

Custom Negotiation Strategy

PRG develops personalized plans tailored to your unique needs and financial capacity, providing strategic approaches that align with your budgets, your risks, and your long-term goals.

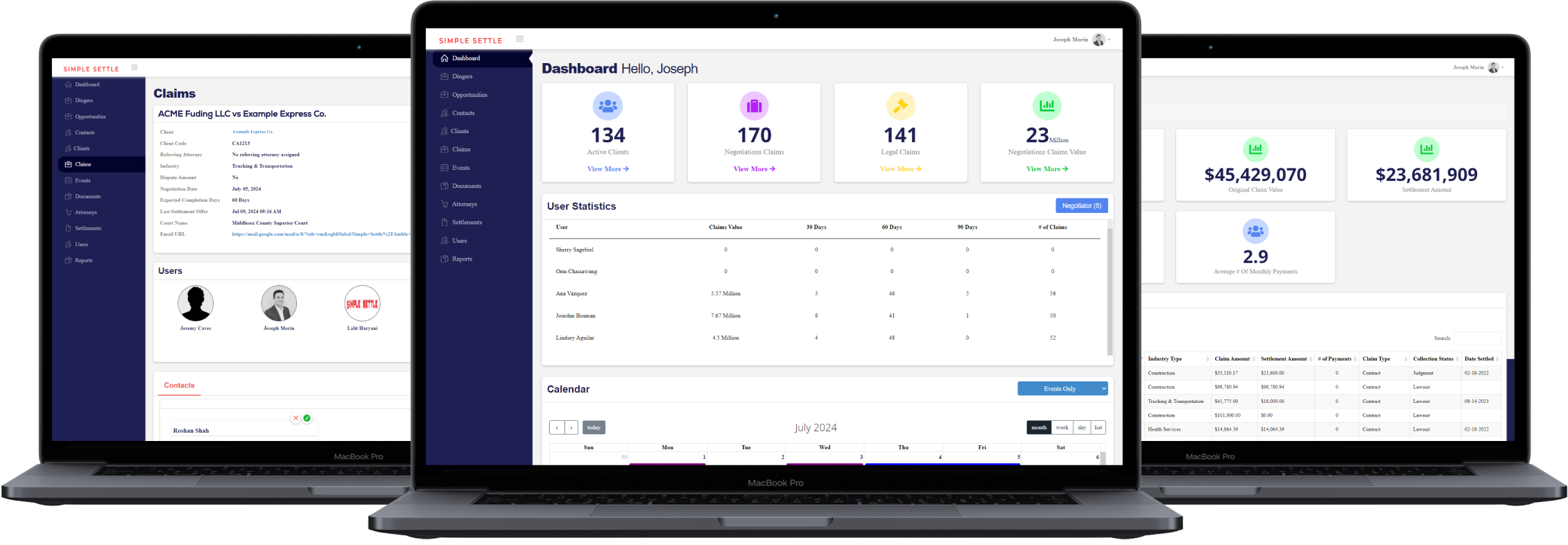

Leveraging Technology to Streamline Operations

PRG believes firmly in leveraging cloud technology such as our proprietary SimpleSettle CRM platform to streamline communication with creditors and with clients across departments, personnel, and geographies, ensuring real-time accuracy and enhanced efficiency in across the financial management spectrum.

PRG's Proprietary Debt Negotiation Portal

PRG has developed a proprietary software tool designed specifically for business debt negotiations. While it remains exclusive to our negotiators, this advanced cloud technology empowers them to streamline processes, enhance strategic decisions, and achieve optimal outcomes for our clients, combining precision technology with human expertise to deliver the best possible result.

Industries Served

At PRG, we understand that every industry faces unique financial challenges and regulatory landscapes. Our expertise spans a diverse range of sectors, allowing us to tailor our strategic debt negotiation and financial management solutions to meet the specific needs of each industry. From logistics to healthcare, our industry-specific insights enable us to empower businesses with the right strategies to navigate complexities and unlock profit opportunities.

Unlock Your Business Potential with PRG

PRG offers a customizable, scalable, and cost-effective system, outperforming most alternatives.

Hear True Stories from Awesome Clients

PRG has been an important partner

“PRG is a trustworthy, proactive, and assertive professional services provider. I found their approach and tact towards sensitive business matters to be consistent and accurate. Very happy to be working with PRG.”

Diego P.

Executive Vice President

Fashion Design & Development Co.

“My husband and I almost had a heart attack when we got served a frivolous lawsuit and understood the legal fees associated with being sued. We were totally panicked and PRG literally saved us. They were lovely and amazing at each and every turn. Darrel is intelligent and kind and you do not feel nickel and dimed. What an amazing team!”

Marta M.

President

Equipment Manufacturing Company

“PRG has been an important partner to us over the years. Our business was forced to accept a new reality when many of our customers were unable to meet their obligations and we simultaneously experienced an issue with a major supplier. A domino effect was created by these events, but PRG’s team and their referring attorneys negotiated arrangements that allowed us to remain competitive. I cannot thank PRG enough and recommend them to any small business facing similar challenges!”

Mike C.

President

Home Healthcare Company

“Dear PRG, Thank you for being there when I needed you most. When a slow-down gripped my business a few years back and I was forced to hire legal counsel, I honestly don’t think we could have survived without PRG’s management of the process. You helped us negotiate several compounding business problems that were threatening our existence within a budget we could afford, and we have emerged stronger. My company has been in business for 20+ years and today I feel confident the future is more prosperous than ever thanks to PRG!”

Grace A.

President

Underground Utilities Contractor

“I’ll be forever grateful that Jari reached out to us in 2017. A few years back, my company was facing very difficult challenges. As a licensed contractor in the state of California, there are serious ramifications when creditors begin circling the wagon. PRG and their awesome referring attorneys were able to contain every single problematic creditor through continuous negotiations. They managed a complex web of challenges which ultimately resulted in a complete restructuring of my company. Today I am happy to report that PRG is our Virtual CFO and we are doing better than ever. I am truly excited for the future and glad PRG is at my side.”

Martin L.

President

Note: PRG has over 15 years of experience in debt negotiations and settlements. However, please note that results may vary. Each case is unique and influenced by multiple factors including, but not limited to, the amount and type of debt, the debtor’s financial situation, and the creditor’s willingness to negotiate. Therefore, while we strive to provide the best possible outcomes, we cannot guarantee specific results.

Book Your Strategy Session

Thank you for contact PRG. We will contact you soon.